Have you come across where you are stuck after selling property and don’t know, how to save tax on property sale or what to do with the capital gains? Then you are definitely at the right place, I hope Reading this short article would help you overcome the problems.

Profit made on stocks, gold, movable or immovable property etc. are liable for tax under short-term and long-term capital gains based on the duration of property held by the owner. To know about tax on stocks click here.

WHAT IS CAPITAL GAINS?

Capital gains are the profit made on the transfer of Assets (properties). That can be calculated by taking the difference between the selling and purchase price of an asset.

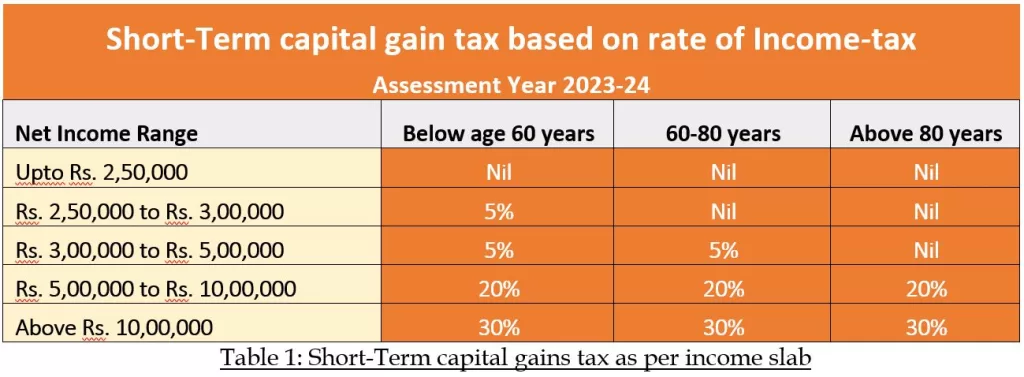

Short-term capital gains are when the property are sold before 24 months of holding. charged as per total taxable income of the taxpayer as mention below.

Long-term capital gains is applicable when the property is sold after holding for 24 months taxed at 20%.

So, now you might be thinking it’s more than short-term tax but it isn’t. because the tax benefits only can be claimed under long-term capital gains

5 TIPS TO SAVE CAPITAL GAINS TAX ON PROPERTY SALE?

1. Purchase or Construct Residential Properties

Tax exemption can be claimed under section 54 As Amended by Finance Act 2022, if the following conditions are met.

- The Asset transferred should be a long-term capital asset, being a residential house property.

- The capital gains from the sale of Residential property shall be utilized to purchase residential property within a time period of 1 year prior to the sale of the original property or 2 years after the sale of the original property.

- If used for construction of house then it should be concluded within 3 years from the date of sale of the original property.

- The new Residential property has to be located in India.

Limitations under section 54 :

- The following above exemption will be withdrawn if the newly purchased or constructed property is sold within three years of its purchase/construction

- The tax exemption is for long-term capital gain for not more than 2 crores & would be available once in the lifetime of a seller.

- With effect from Assessment Year 2021-22, the Finance Act, 2020 has amended Section 54 to extend the benefit of exemption for 2 Residential Houses.

Note :

- If the investment made in the new property exceeds the capital gains earned from the sale of the original property, the exemption shall be limited to the capital gain amount.

- If the investment made in the new property is lesser than the capital gains earned, then, the remaining capital gains shall be taxable at a flat rate of 20 percent.

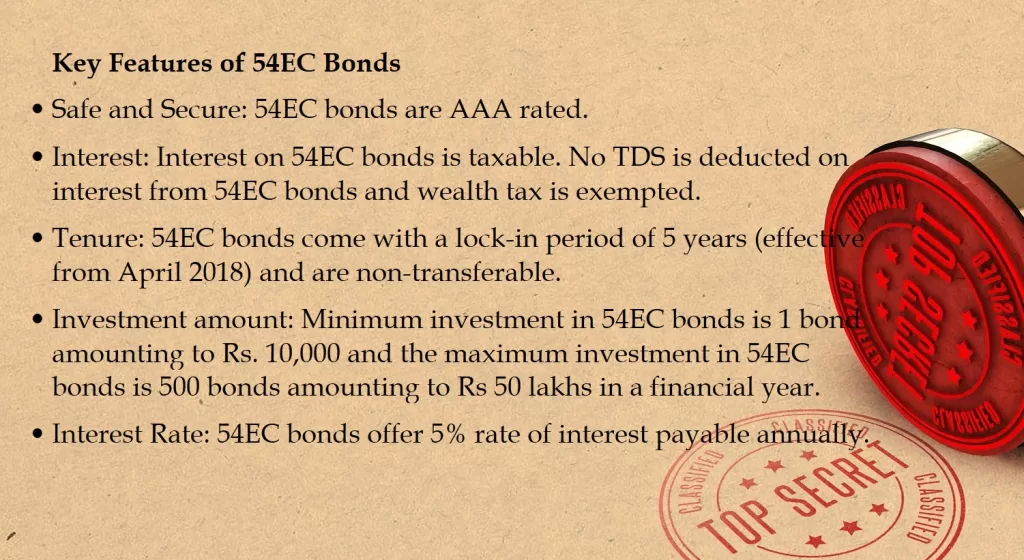

2. Invest the Capital Gains in Specific bonds:

Section 54EC allows an investor to claim a tax deduction by investing the capital gains into bonds issued only by

- REC (Rural Electrification Corporation Ltd),

- PFC (Power Finance Corporation Ltd),

- NHAI (National Highways Authority of India)

- IRFC (Indian Railways Finance Corporation Limited).

The benefit of investing in 54EC bonds would be available on the sale of land or building (residential or commercial).

3. Setting off Capital gains against Losses:

set off long-term capital gains from the sale of property with any other long-term losses of other Assets including land, house, stocks & gold.

These could be the losses carried forward in the last eight years, along with the losses incurred in the year of claiming the benefit.

4. Invest in small or medium enterprises or in eligible start-ups

Claim tax deduction under section 54GB :

By investing long-term capital gains in small & medium enterprises or in eligible start-ups for buying computers & other such equipments.

Limitations :

- The taxpayer should utilize the net consideration before the due date of filing income tax returns.

- Holding period for new assets should be at least 5 years.

- Available only to individuals or Hindu undivided families (HUFs)

5. Deposit in Capital Gain Account Scheme :-

You are allowed to open a CGAS account only if you are unable to invest it in a house before the due date for filing income tax returns.

Now, Imagine if you are unable to purchase or construct house before the due date of filing income tax return (July 31 after the given assessment year).

Then one should deposit the amount into Capital gain deposit account schemes so that it could be used to purchase or construct a house within the specified time limit of 2 years or 3 years, as the case may be.

Note:

- If he does not purchase/construct the house within a period of 2 years/3 years, then the amount (for which exemption is claimed) will be taxed as income by way of long-term capital gains of the year in which the specified period gets over.

- if one files income tax returns before availing the benefits of section 54, then capital gains would be taxed under long-term capital gains or short-term capital gains based on a period of holding.

Hope this article to save tax on property sale will be helpful, for more of contents on finance, food & travel visit the website www.miraitagi.com

Useful