WHAT IS INDEX?

It’s basically a method to track the performance of a group of assets / stocks in a standardized way which could be in terms of market capitalization & sectoral base. An Index fund is a basket of a group of stocks, for eg.

INDIA:-

Nifty 50:- It contains the top 50 companies of India in terms of market capitalization.

Bank Nifty: It comprises of maximum 12 Indian banking stocks listed on the National Stock Exchange of India (NSE)

USA:-

S&P 500:- includes the top 500 U.S. publicly traded companies.

Dow Jones:- is a stock market index of 30 prominent companies listed on stock exchanges in the United States

And many more………

WHAT IS FIXED DEPOSITS:-

In a Fixed Deposit, you put a lump sum amount in your bank for a fixed tenure at an agreed rate of interest.

The current rate is at 6.25% as of today in India ( published date).

A Fixed Deposit offers guaranteed returns. Unlike market-led investments where returns fluctuate over time, the returns on an FD are fixed when you open the account. Even if interest rates fall after you open a Fixed Deposit, you will continue to receive the interest decided at the start. FDs are considered much safer than investments in other assets like equity.

IS INDEX INVESTING BETTER THAN FD? LET’S FIND OUT.

FD returns considering compounding Annually for period of 5 years.

For example, if you deposit a sum of Rs. 5,00,000 for 5 years at 6.25% interest, the final mature amount would be:-

Maturity Amount= Rs. 5,00,000+5,00,000 {(1 + 6.25/100) 5 -1}

Maturity Amount= Rs. 677040/-

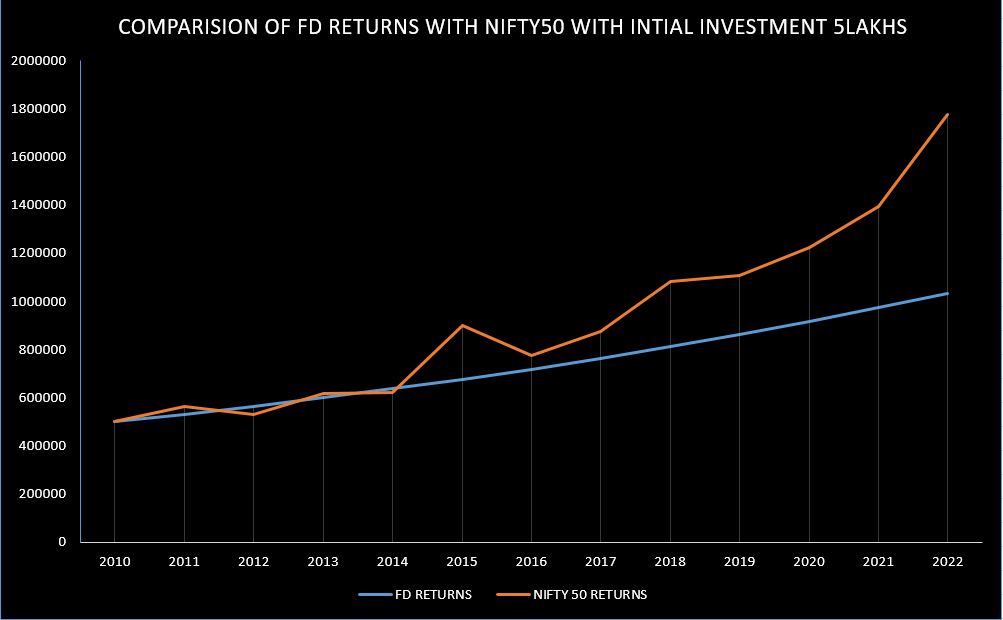

Can you Guess the returns in Nifty50 ?

Investment would have been doubled because Nifty50 in last 5 year i.e. from 2017 to 2022 has grown with a CAGR of 12.11% (i.e. from 10500 to 18600 till date)

Final Amount= Rs. 5,00,000+5,00,000 {(1 + 12.11/100) 5 -1}

Final Investment =Rs. 885500/-

Nifty50 returns are nearly more than double that of FD with CAGR of 12.11% & 6.25%.

THOUGH NIFTY GIVES HIGHER RETURNS DOES IT MEAN TO INVEST IN IT?

Type of investment you need clearly depends on your financial goal and risk appetite. Investing in the Nifty50 index necessarily means to track on daily basis unless there’s a black swan moment.

For the near-term goal, FD investment would sound safe and secure. There are also times when index returns are negative or way below other assets, Understanding and Investing in developing markets for the long term can be proved to be an effective strategy where the effect of compounding can be achieved.

“profit is a reward for the risk taken in business”

For compound interest FD use the following formula –

M= P + P {(1 + i/100) t – 1}

Where in,

P is the principal amount

i is the rate of interest per period

t is the tenure