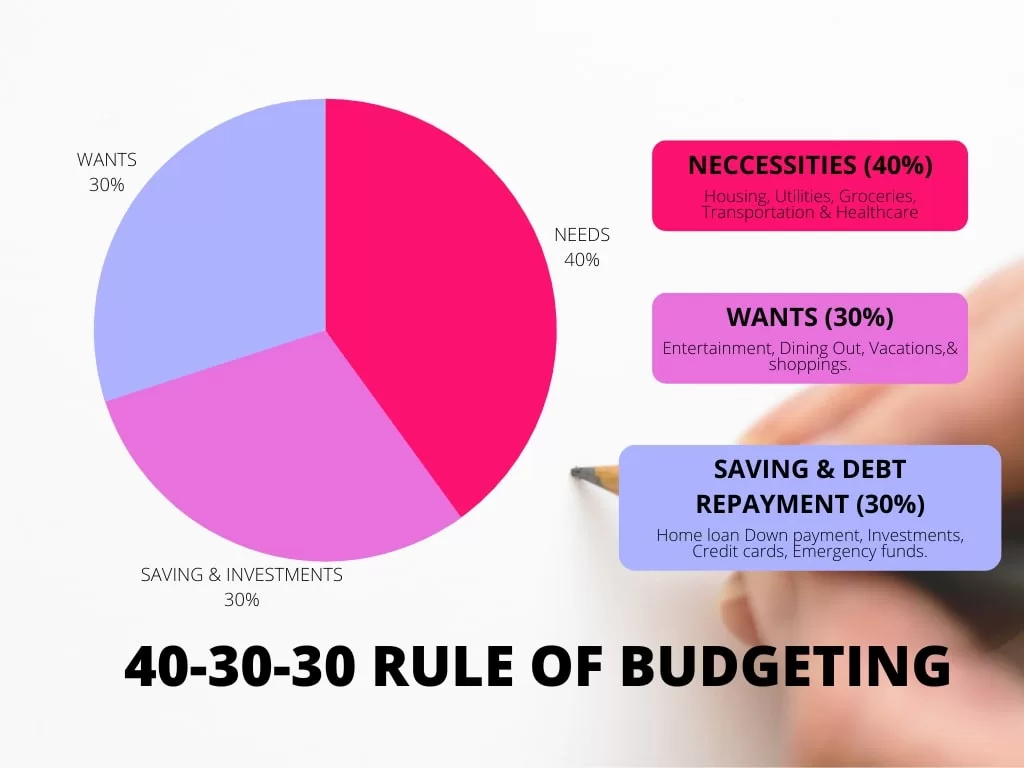

The 40-30-30 rule of budgeting is an effective way of allocating and prioritizing your spending to help one achieve their needs & financial goals. This rule allocates more toward the financial goals vis-a-vis the 50-30-30 rule of budgeting.

WHY BUDGETING IS A MUST?

Managing your finances can be a daunting task, but creating a budget can help you stay organized, achieve financial goals, provides a sense of control over your money & helps you live within your means.

HERE’S HOW THE 40-30-30 RULE WORKS.

Necessities (40%):

This category includes essential expenses such as housing, utilities, groceries, transportation, and healthcare. It’s recommended that this category not exceed 40% of your after-tax income.

Wants (30%):

This category includes discretionary expenses such as entertainment, dining out, vacations, and shopping. This category should not exceed 30% of your after-tax income.

Saving & Debt Repayment(30%):

This final part of Saving & Debt Repayment can be further classified as follows:

Long term saving: which includes savings for long-term financial goals such as retirement, down payment on a home, or other large purchases and even emergency fund. It’s recommended that you allocate 20% of your after-tax income to this category.

Debt Repayment: This category includes payments towards any outstanding debts, such as student loans, credit cards, or personal loans. It’s recommended that you allocate the remaining 10% of your after-tax income towards debt repayment.

WHY THE 40-30-30 RULE OF BUDGETING IS EFFECTIVE?

- The rule of budgeting is simple and easy to understand that could serve as starting point for anyone new to saving or finance management.

- By dividing your income into needs, wants, and savings, the rule helps you prioritize your spending and focus on what is most important.

- Allocating 30% for saving and investment can help one build a strong financial foundation in a world full of uncertainties. This rule provides a more balanced approach to budgeting by emphasizing more on savings and debt repayment.

By following this rule, one can safeguard that your essential needs are met, your wants are enjoyed, and your savings are growing for secure financial needs in the future. However, as with any budgeting rule, adjusting the percentages to fit your circumstances and financial goals is important.

Latest Articles on Finances -Lifestyle-Travel

- Investing Made Easy: Mastering the Rule of 72, 114, and 144

- Real Estate : Is it the Golden Ticket or Fool’s Gold?

- Score Cheap Flights: Tips and Tricks from Frequent Flyers

- Achieve Financial Balance with the 40-30-30 Rule of Budgeting: Managing Your Needs, Wants, Savings, and Debt.

- BUDGET TRAVEL GUIDE TO MALDIVES

Editorial Disclaimer: Opinions expressed here are the mine alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.