Want to buy a house? Starting a Business? Want a Car Loan? All comes down to Credit Score to get loan at lower rates. These 5 ways can help you build credit score fast.

What is Credit Score?

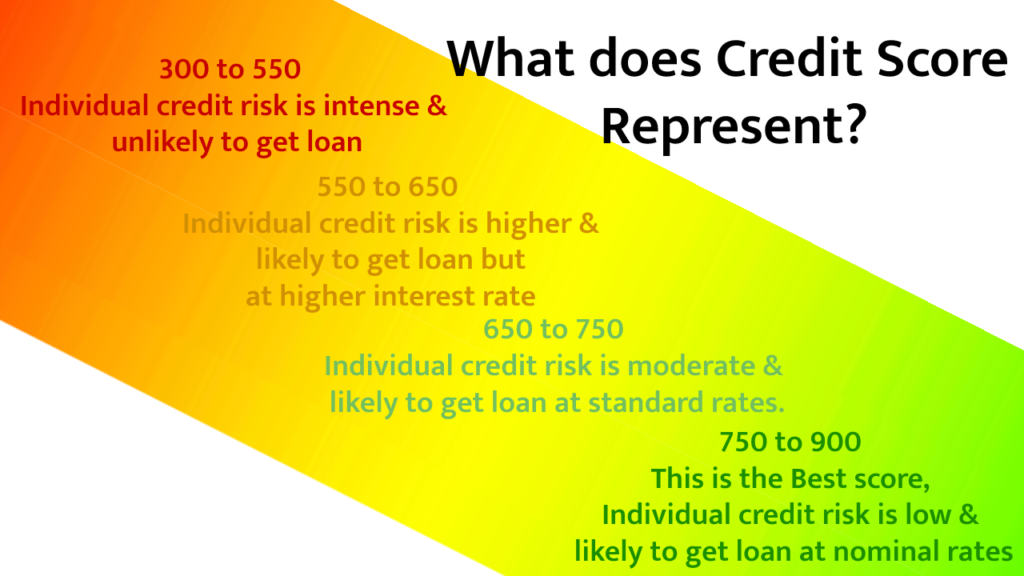

Credit Score is a 3-digit number ranging from 300 to 900 issued by Credit Bureau for an individuals or commercial entity based on their total debt, repayment history, credit age, Type of loan & new loan etc.

These Credit Bureaus are licensed to access and record the credit data of individuals or commercial entities, to analyzes and generate Credit reports & scores of borrowers.

Credit Score generated by Each bureau for the same individuals certainly varies, as each credit bureau has it’s own way of analyzing.

Why is credit score required?

Credit score defines your credit risk & ability to repayment of loan. This score is essential for a banker or a lender to understand the risk factor before approving your loan.

A good Credit Score would help you in getting loan approval without difficulty for business startups or at times of financial crisis at favorable interest rates.

It makes you eligible for the best interest rates on loans, mortgages, and credit cards.

WHAT’S the Best Credit score to get loan?

5 WAYS TO Build Credit Score Fast ?

Having a bad credit score is not the end, because everything can be built with time & patiences. Follow these important points that helped me improve my credit score.

1) Timely repayment of loan:

This is important to do so as history of payment defines your character i.e. on time payment gives the indication of being responsible borrower.

Any defaults or bad credit stays on credit report for nearly 7 years which could bring down your score so, avoid any defaults. If you haven’t been consistent with repayment then I’ll suggest to start here to boost your credit score.

2) Avoid too many credit application at a time:

Every time you apply for credit an inquiry is made on your credit report, irrespective of being approved or denied. These inquiries lower your credit score temporarily. It might not be a huge thing for one credit inquiry but applying for many at a time would really impact your credit score as it would indicate you as a greater risk to a lender.

It would be better to space the application over time, go for 1 or 2 in a year, only if you really need one.

3) Make Full payment each billing cycle:

Try to make full payment each billing cycle rather than paying minimum to get the usage of card running. Paying full amount each billing cycle would help you avoid any increase in debt, interest charges and consequently keeping your credit utilization ratio low.

4) Keep your credit utilization low:

It refers to the amount you have used out of the total credit limit.

keep your credit utilization at 30%-40% because higher utilization would considered you as a risky borrower.

If you have higher credit utilization then try to get it down by either paying your credit card balance or increasing your credit limit.

5) Keep track of your credit report & score:

Reviewing your credit report helps you to keep track of mistakes, so you could improve them accordingly or if there’s any error then it could be removed via dispute.

You can get free credit report online with any of above mentioned credit bureaus, for more of such financial content click here.

Editorial Disclaimer: Opinions expressed here are the mine alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.